Loan Payoff Calculator with Extra Payments

Loan Details

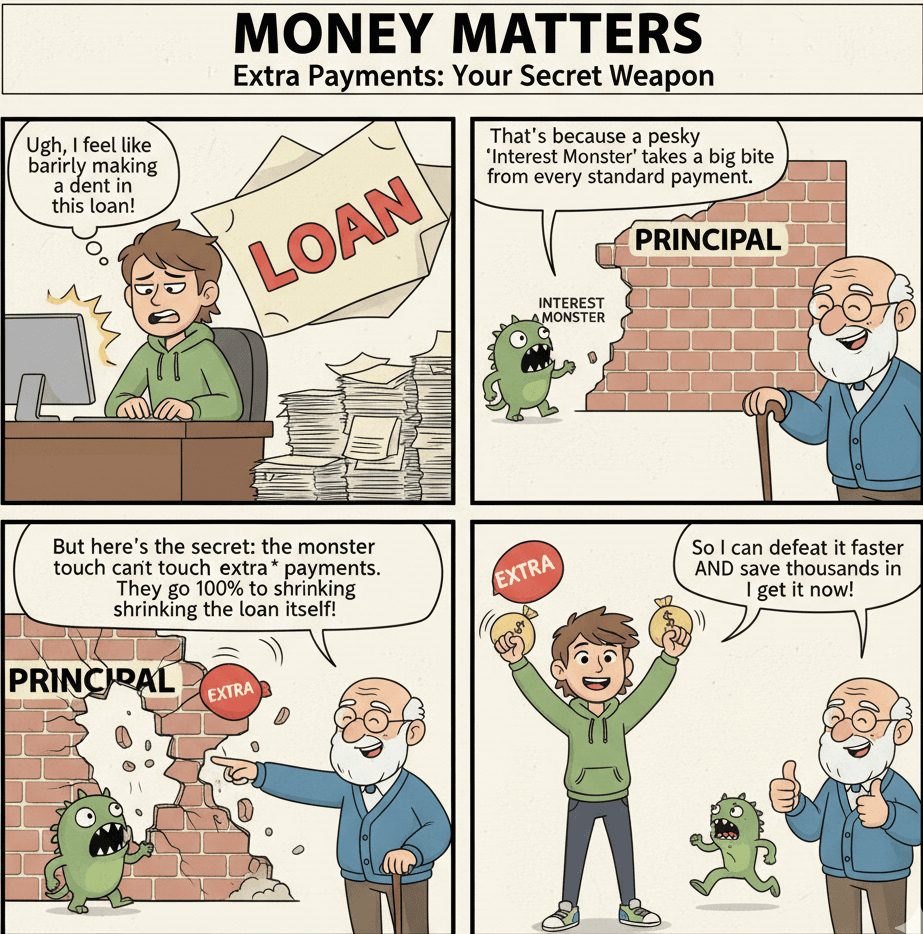

How Extra Payments Can Save You Thousands

Making extra payments on your loan, even small ones, can have a huge impact over time. By paying more than your required monthly payment, you reduce the principal balance of your loan faster. This means you'll pay less interest over the life of the loan and become debt-free sooner. This calculator helps you visualize that impact by showing you the new payoff date and your total interest savings.

For example, adding just $100 extra per month to a $150,000 loan at 5.5% can save you over $20,000 in interest and cut years off your repayment schedule.

Frequently Asked Questions

What kind of loans can I use this calculator for?

This calculator is versatile and can be used for various types of loans, including mortgages, auto loans, personal loans, and student loans. As long as you have the loan amount, interest rate, and monthly payment, you can see how extra payments will affect your payoff timeline.

How is the interest calculated?

The calculator uses a standard amortization formula. Interest is calculated monthly on the remaining loan balance. When you make an extra payment, that entire amount goes toward reducing the principal, which means the next month's interest charge will be slightly lower, accelerating your progress.